Custodial Accounts (UTMA/UGMA)

Assets in a custodial account belong to the minor. Any income earned in a custodial account is taxed to the minor. A custodian, usually an adult relative, controls the assets until the minor reaches the age set by state law (21 in most states). Assets in a custodial account can be used to pay for education expenses for the minor.

Savings Bond Interest Exclusion

Exclusion Rules

Interest from qualified savings bonds redeemed by the taxpayer can be excluded from income if:

- The taxpayer paid qualified education expenses during the year for the taxpayer, spouse, or a dependent claimed on the taxpayer’s return.

- Filing status is not Married Filing Separate.

If proceeds from the redemption (interest and principal) are more than adjusted qualified education expenses, only a percentage of the interest is excludable.

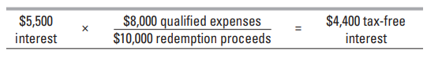

Example: Marty redeemed qualified bonds for $10,000, including accrued interest of $5,500. He paid $8,000 of qualified education expenses during the year. His excludable interest is:

Income Limit

The exclusion is limited by adjusted gross income. Check with your tax professional for income limitations.

Qualified Savings Bonds

- Series EE bonds issued after 1989 and Series I bonds

- Issued to a person who was age 24 before the bond’s issue date. The issue date is the first day of the month in which the bond was purchased (for example, a bond purchased on May 25 has a May 1 issue date). The issue date is printed on the front of the bond.

- Issued in the name of the taxpayer and/or spouse. There can be no other co-owners, including the taxpayer’s child. The bond can have a pay-on-death (POD) beneficiary, including a child.

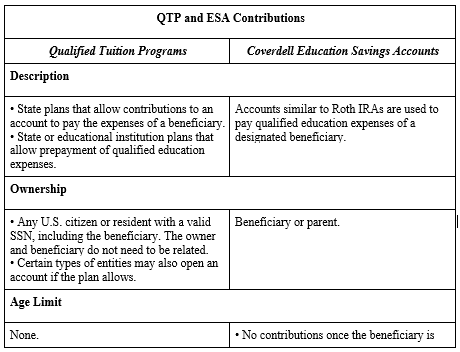

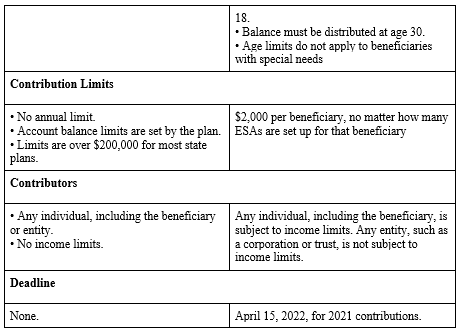

Qualified Tuition Plans (QTPs) & Educational Savings Accounts (ESAs)

QTP and ESA Tax Benefits

Contributions to a QTP or ESA are not deductible. Earnings accumulate tax-free. Distributions are not taxable if less than the beneficiary’s adjusted qualified education expenses in the year of distribution. Contributors can contribute to both a QTP and an ESA in the same year for the same designated beneficiary.

Note: QTPs are also called college savings plans or 529 plans

Qualified Expenses

- Tuition, fees, books, supplies, and equipment required for enrollment or attendance of the designated beneficiary at an eligible institution. Qualified expenses do not include courses involving sports, games, or hobbies, unless part of the student’s degree program.

- Expenses for special needs services of a beneficiary with special needs incurred in connection with enrollment or attendance.

- Room and board for students enrolled at least half-time in a degree or certificate program. Expenses are limited to the room and board allowance included in the cost of attendance set by the school for financial aid purposes or the actual cost of campus housing, if greater.

Did You Know? Most colleges and universities set room and board allowances for students who live on campus, off-campus, and with parents. Check the school’s financial aid website for costs of attendance.

- The purchase of computer or peripheral equipment, computer software, or internet access and related services is a qualified expense. These items must be primarily used by the beneficiary during any of the years the beneficiary is enrolled at an eligible educational institution. The computer software must have a predominantly educational nature.

QTPs.

For QTPs, the following expenses are considered qualifying expenses:

• Apprenticeship expenses. Expenses paid for books, fees, supplies, and equipment required for participation in a registered apprenticeship program.

• Student loan repayment. The principal or interest payments on any qualified education loan of the beneficiary or sibling up to a cumulative maximum of $10,000 per beneficiary and sibling.

• K–12 education. Expenses for enrollment or attendance at any public, private, or religious school that provides K–12 education as determined under state law. Qualified K-12 tuition expenses may not exceed $10,000 per beneficiary per year.

ESAs.

For ESAs, the following expenses qualify:

- Tuition, fees, books, supplies and equipment, academic tutoring, special needs services.

- Room and board, uniforms, transportation, supplementary items and services, including extended day programs if required or provided by the school.

- The purchase of computer technology, equipment, or internet access and related services is a qualified K-12 education expense if it is to be used by the beneficiary and the beneficiary’s family during any of the years the beneficiary is in elementary or secondary school. This does not include computer software unless predominantly educational.

Adjustments

Qualified expenses are reduced by:

- Tax-free assistance (scholarships, fellowships, grants, employer-provided assistance, veterans benefits, and any other nontaxable payments except gifts or inheritances).

- Amounts used to figure an education credit or deduction.

Contact Us

There are many events that occur during the year that can affect your tax situation. Preparation of your tax return involves summarizing transactions and events that occurred during the prior year. In most situations, treatment is firmly established at the time the transaction occurs. However, negative tax effects can be avoided by proper planning. Please contact us in advance if you have questions about the tax effects of a transaction or event, including the following:

- Pension or IRA distributions

- Significant change in income or deductions

- Job change

- Marriage

- Attainment of age 59½ or 72

- Sale or purchase of a business

- Sale or purchase of a residence or other real estate

- Retirement

- Notice from IRS or other revenue departments

- Divorce or separation

- Self-employment

- Charitable contributions of property in excess of $5,000