Understanding Income Brackets and Rates for this 2021 Tax Season

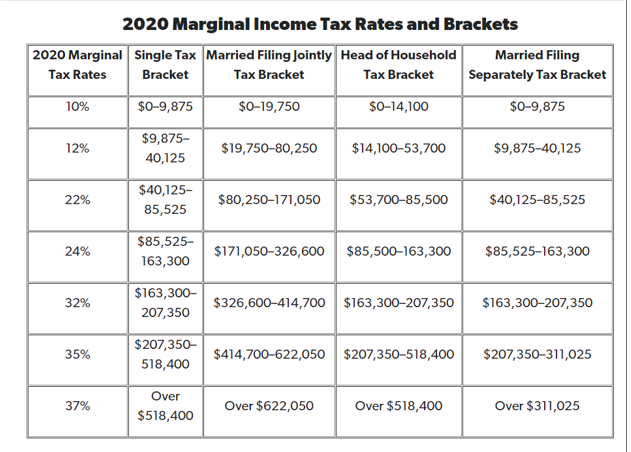

Here’s how income brackets and tax rates work..Your tax rate (the percentage of your income that you pay in taxes) are based on what tax bracket (income range) you’re in. Take note that for 2020 tax year, the tax rates are the same, but there are some slight changes to the brackets. Reference chart below to see which bracket you fall under. Credit of chart to Dave Ramsey

When paying your taxes, you have the option of taking the standard deduction or itemizing your deductions. If you itemize your calculating your deductions one by one. Although itemizing and tedious, when done, it could be worthwhile if your itemized deductions exceeds the amount of the standard deduction.

For the 2020 tax year, the standard deduction went up slightly to adjust for inflations. For instance, Single filer’s standard deduction was $12,200 in 2019, now for a single filer is $12,400. For Married filing jointly filers received $24,400 in 2019 now receive $24,800.

Every situation is different. Talking to a tax professional is ideal if you’re unsure of whether to take the standard deductions or to itemize.